The independent financial advisor has more competition than ever. Online options exist for virtually every type of insurance, many investment products, and even “advice” in the form of a roboadvisor. That said, those competitors lack one key ingredient: You.

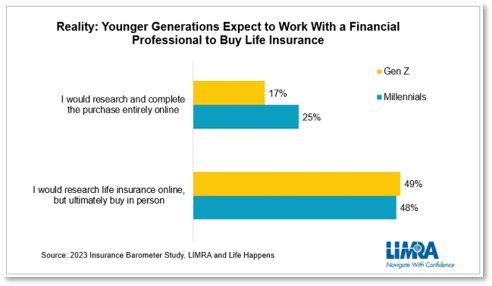

Many insurtech platforms seek to effectively replace the advisor, believing that the consumer can be accessed directly, educated and motivated to apply for life insurance without seeking guidance from an expert. While this is true for some consumers, available research shows that many consumers would prefer to learn online, but when it comes time to make a buying decision, they prefer working with a professional.

That said, viewing this as an either/or question may be a flawed strategy. The forward-looking advisor must meet the consumer where they are, providing high quality educational content, a low-friction buying experience and the ability to connect with a professional if the need arises, as seen in Figure 1, below.

Figure 1: Consumer Buying Preferences

Fortunately, the second generation insurtech solutions now available do just that. Rather than seeking to replace the advisor, they seek to enable them. These solutions allow advisors to meet the needs of not only an individual client, but also partner more effectively with referral sources like a P&C Agency, a mortgage lender, or any other relationship they feel is ripe with potential if the right fulfillment solution can be deployed.

Working with Individual Clients

When the client is ready to move forward, with or without a conversation with their advisor, a completely client-driven online application process removes the administrative burden that comes with first generation eApps that require the advisor to complete the application with the client. It also allows the client to complete their application at the time of their choosing, even if that is 11:00 PM on a Tuesday! With a healthy client, an instant underwriting decision can mean being done with the entire process in hours rather than days. Even if an instant approval isn’t available, exam-free underwriting can render a decision within a few days, delivering a total under time measured in days versus weeks.

Working with a Referral Source

All of the points discussed above relative to individual clients apply when working with a referral source, as the ultimate insurance buyer remains an individual client. The real issue here is one of scale. If the relationship with the referral source does lead to a significant volume of new insurance clients, outdated application processes would make it impossible to fulfil without taking on additional staff or pulling them away from other duties, making the business unprofitable, a distraction or both.

Success in either scenario will also rely heavily on the ability to guide a steady stream of potential clients to the educational resources and application portal, making a solid marketing strategy a must. There remains, however, another crux that needs to be overcome: Which insurtech provider to partner with?

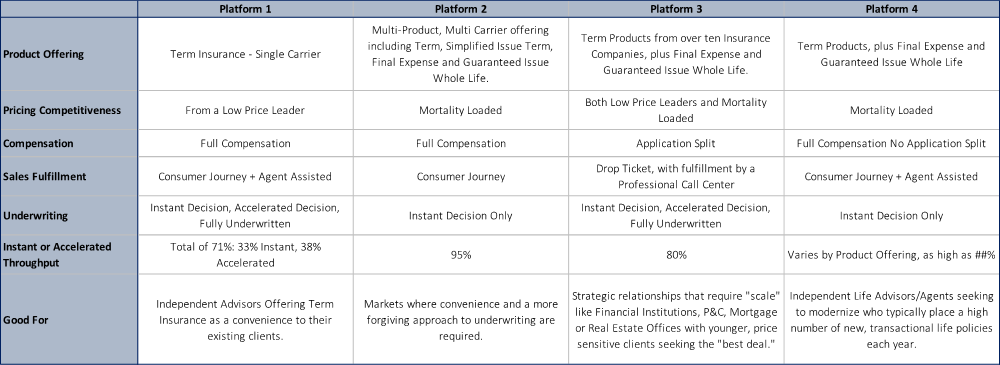

The mistake we see in approaching this question is seeking a singular “best platform” that can address the unique requirements of working with both individual consumers and strategic relationships. The truth is that the “best” platform will change depending on the market the advisor serves. Working in the middle market? You may need a product and process that is heavy on convenience and has a forgiving underwriting “box” rather than being optimized to provide the absolute lowest price. A P&C Agency that has built a value proposition centered on delivering the best price, on the other hand, may be willing to sacrifice the forgiving underwriting in order to deliver the best possible price.

Some of the nuances of available platforms offering a modern, “Click-to-Buy” experience are summarized in Figure 2, below. No two platforms are alike, with each having their own relative strengths. That’s why we’ve spent so much time researching the insurtech providers currently in market. By working with the advisor to develop an intimate understanding of their relative strengths and weaknesses, we’re able to play matchmaker in a way, identifying the best fit for their specific opportunity.

Table 1: Available “Click-to-Buy” Platforms

The only missing piece of the puzzle? Again, it comes back to you, the advisor. The specifics regarding what you are trying to accomplish by partnering with an insurtech platform will largely determine which of the available choices will be the best for you, your centers of influence and your clients.

Give us a call to talk through how the right insurtech partner can help make small face term insurance profitable again or unlock that relationship you just know can produce a steady stream of new insurance clients if you can get to scale.

The contents of this document should not be considered as tax or legal advice. Any information or guidance provided is solely for educational or informational purposes and should not be relied upon as a substitute for professional advice. It is always recommended to consult with a licensed financial or legal advisor for specific guidance related to your individual situation.